About Us

Established in Mauritius since 2019, Redwood Finance Limited is an independent, privately owned company licensed as an Investment Dealer (Full Service Dealer excluding Underwriting) bearing License No. IQ18000023 and regulated by the Financial Services Commission. Redwood Finance is a member of the Stock Exchange of Mauritius (the ‘SEM’). Redwood Finance prides itself with trust, reliability, and integrity, with best-in-class solutions and advice that meets the specific needs of each and every client.

Our Experts

Our Work Process

- 1

Client Profiling

Goals & Objectives

Risk Appetite - 2

Portfolio Construction

Build portfolio according to client profile

- 3

Trading

Implement Proposed Portfolio

- 4

Reporting

Periodic Reporting of Portfolio Performance

- 5

Monitoring / Rebalancing

Ongoing Monitoring & Rebalancing of Portfolio

Since We Started

Markets

Countries

Currencies

Our investment universe comprises of over 150 markets across various assets classes ranging from equities/bonds/derivatives,

trading in 24 currencies – in short, we ensure we have access to wherever there is money to be made for long term investments.

Meet Our Experts

Mitesh Hassamal

Mitesh is a skilled financial services professional with experience across all major financial markets including New York, London and Hong Kong. Between 2010-2018, Mitesh worked on the Equity Capital Markets desk at UBS in the New York office with a focus on capital raising across several sectors. Between 2003-2010, Mitesh worked at Credit Suisse across several businesses including corporate finance and capital markets. Mitesh has advised and executed transactions for corporates, institutional investors, family offices, and government entities. Mitesh holds a BSc (Hons) in Management Sciences from the London School of Economics (‘LSE’).

Vashambha Comaren

Vashambha is a seasoned Senior Trader with over 23 years of experience. Vashambha oversees the domestic market investment at Redwood Finance Limited and leads the local stockbroking activities. Owing to Vashambha’s previous roles in the industry (at SBM Securities, AAMIL, LCF Securities), she wields a strong network and is proficient at maintaining client relationship. Vashambha is also well versed in the legal framework for the stock market in Mauritius.

Kalpana Hassamal-Yerrigadoo

Kalpana is a multi-faceted finance professional. Dynamic and passionate, she is equipped with strong technical, analytical and managerial skills gained through her vast exposure in the industry. Doing business is in her DNA. Kalpana started her career in the 90’s at PwC before embarking in the banking sector. She has been working in different international banks such as HSBC and Standard Bank (Mauritius) Limited whereby she gathered a huge array of experience as Compliance Manager and Investment Banking Manager. She overviewed the Africa Growth portfolio, Debt Solutions, Credit and Risk Department as well as Personal Banking. Part of the Internal Audit department and relationship Manager Corporate Banking Division at the now Maubank (previously The Mauritius Post & Coorperative Bank Limited , (MPCB) the banking journey enabled Kalpana established banking relationships with high net worth individuals and created a solid network. Kalpana was the Financial Consultant at ACMS (now Axis) in a leading investment company responsible essentially for international portfolio. Kalpana joined Redwood Finance Limited in 2020 as the MLRO, and is also responsible for compliance and business development.

Our Services

Discretionary International Portfolio Management

While managing your investments is a top priority, it may require more time and attention than your busy schedule permits. Our team of experienced experts is precisely designed to address this situation: investors who desire peace of mind and the time to focus on other priorities can hand over day-to-day investment responsibility to us, whilst retaining an element of control over the parameters of the mandate. Our dynamic allocation strategy and disciplined investment process ensures that your portfolio is being managed in line with your risk profile and appetite.

Advisory

This works well for clients who wish to have the final say regarding their investments. Our team of experts will provide advice and up-to-date market news and outlook to assist you in your decision-making.

Institutional Bond Execution Services

We pride ourselves on working closely with our clients to ensure they benefit from our extensive bond market knowledge. Trading at the best price available to our clients is the key focus of our best execution policy. We maintain flexibility when it comes to settlement and enjoy a healthy working relationship with a number of local and global custodians.

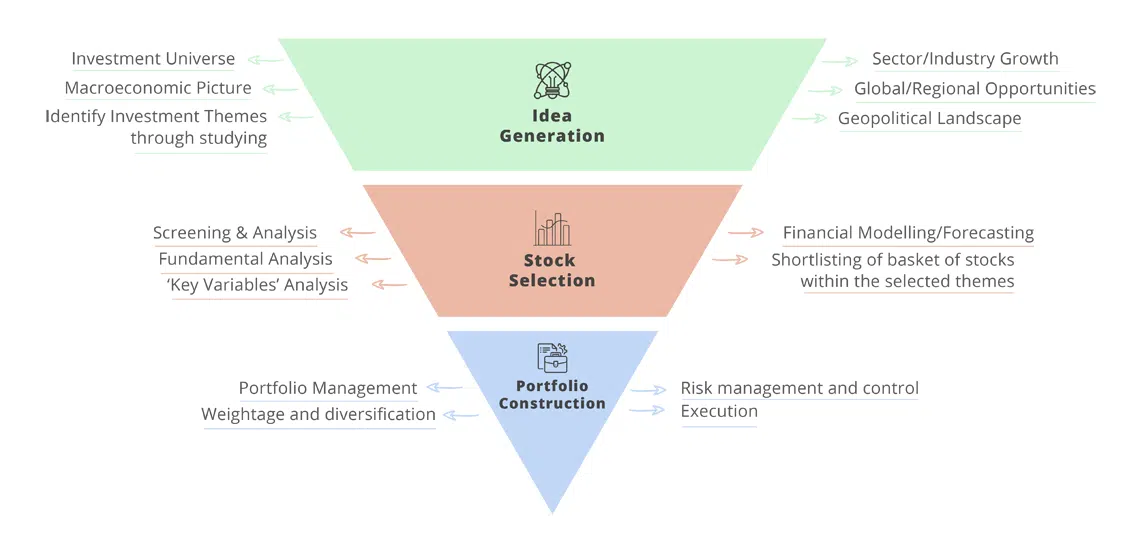

Investment Philosophy

At Redwood, we engage in a top-down investment approach. We start by identifying investment themes best positioned for future growth, within which we analyse, select and invest in a diversified basket of the best positioned companies globally.

Diversity remains one of our key philosophies and we aim to expose our client to different business lines geared towards future growth, in short we make our clients shareholders in businesses across the world to enable them to benefit from business trends of the future.

We thrive at understanding clients’ needs and risk appetite to construct tailor made portfolios.

We invest directly in stock markets, as opposed to investing in products and externally managed mutual funds which just add up layers of fees, that are often hidden and incorporated in the price in most cases. Moreover, going direct in equities and bonds means, you can exit investments instantaneously, with the proceeds being transferred back to your bank account within a maximum of 2-3 workings days.

Careers

Redwood Finance is consistently looking for ambitious and talented financial services professionals. Current open positions as follows:

Investment Analyst.

- Niche player in the asset management and brokerage business, offering unparalleled global markets experience.

- The analyst will receive substantial exposure across a broad range of investment areas globally including Equities, Fixed Income, Commodities and Alternatives (Private Equity).

- As a member of the Redwood Finance team, you will work on broad market themes as well as specific client mandates for asset management and brokerage execution.

- Looking for both graduate entry level job and experienced analysts with up to 1-2 years of work experience.

- Substantial training and support provided on the job.

- Understand global financial markets for key themes and outlook at the macro, sector and company specific levels.

- Analyse company financials, and formulate a view on growth and profitability prospects.

- Understand company valuation techniques.

- Analyse financial markets and trading activity to understand market drivers.

- Prepare regular market updates including market statistics and company updated financials.

- Solid grasp of Excel, PowerPoint and Word applications, which can also be learned on the job assuming an existing basic knowledge.

- Training will be provided on-the-job however basic understanding of finance and accounting will be important.

- Suitable for highly motivated and ambitious graduates seeking to understand global financial markets and investment banking.

- Understand company financials that help guide the investment decision.

- Follow specific industries to learn the key drivers and trends that influence companies’ and investors’ decisions.

- Demonstrated academic achievement and solid interest in the financial sector.

- Background in Finance, Banking, Accounting, Economics, Mathematics, Statistics, or quantitative areas.

- High grades and analytical skill are a must to succeed in this role:

- (i). Undergraduate First Class Honors ideally or very good 2:1.

- (ii). HSC results: Ideally A-A-A, or minimum A-B-B.

- Excellent written and verbal communication and problem-solving skills.

- Hardworking with the ability to work independently and as part of a team.

- Excellent PC skills with proficient knowledge of Excel, Word and PowerPoint.

- Very competitive for new graduates or recent graduates, plus end of year bonus.

- Meaningful opportunity to build a network of colleagues both within the Redwood network and outside that will strengthen your career throughout your professional life.

- Keen and willing to learn about global financial markets and develop investment and corporate finance skills.

- For applications, you can email: info@redwood-finance.net

- For queries, you can call: +230 454 3153.

Wealth Management Relationship Officer.

- Niche player in the asset management and brokerage business.

- Focused on global and international markets across several asset classes including Equities, Fixed Income, Commodities, Real Asset and Alternatives (Private Equity).

- Diversified client based across domestic and international, including both families and institutions.

- Looking for experienced wealth management relationship officers with proven relationship for both portfolio management and broader themes including succession planning, financial independence, among additional themes.

- Technical support provided for client engagement.

- Client relationship management: Build and maintain long-term relationships with high-net-worth individuals by acting as the main point of contact.

- Financial planning and advice: Assess clients’ current financial situations and develop personalized financial plans and investment strategies tailored to their goals and risk tolerance.

- Portfolio management: Monitor and optimize client investment portfolios, ensuring they align with financial objectives and adjusting strategies as needed based on market conditions.

- Market expertise: Stay up-to-date on market trends, economic developments, and regulatory changes to provide accurate and timely advice.

- Sales and business development: Generate new business and achieve revenue targets by proactively identifying client needs and cross-selling suitable products and services.

- Internal and external collaboration: Work with other partners such as tax advisors, legal professionals, and product specialists, to provide comprehensive financial solutions.

- Compliance: Ensure all client interactions and actions are compliant with legal, regulatory, and internal policies, such as KYC procedures.

- Client service: Handle client requests, resolve issues, and provide ongoing support to ensure client satisfaction.

- Strong and proven relationships with high-net-worth families or corporates with investable funds.

- Experience in financial sector and particularly wealth management solutions.

- Academic achievement and solid interest in the financial sector.

- Excellent written and verbal communication and problem-solving skills.

- Hardworking with the ability to work independently and as part of a team.

- Very competitive driven by strength and breadth of relationships, with substantial end of year bonus based on performance.

- Meaningful opportunity to build a network of colleagues that will strengthen your career throughout your professional life.

- For applications, you can email: info@redwood-finance.net

- For queries, you can call: +230 454 3153.